United States Dollar / Japan Yen

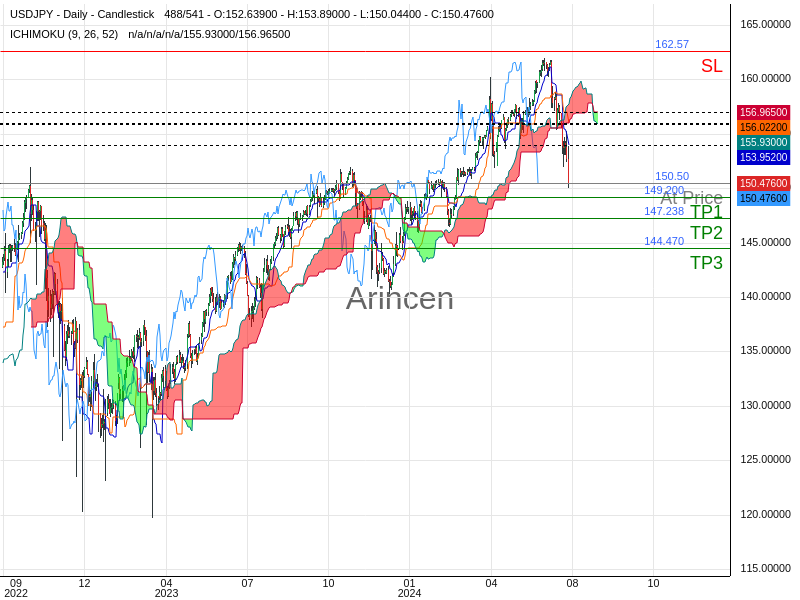

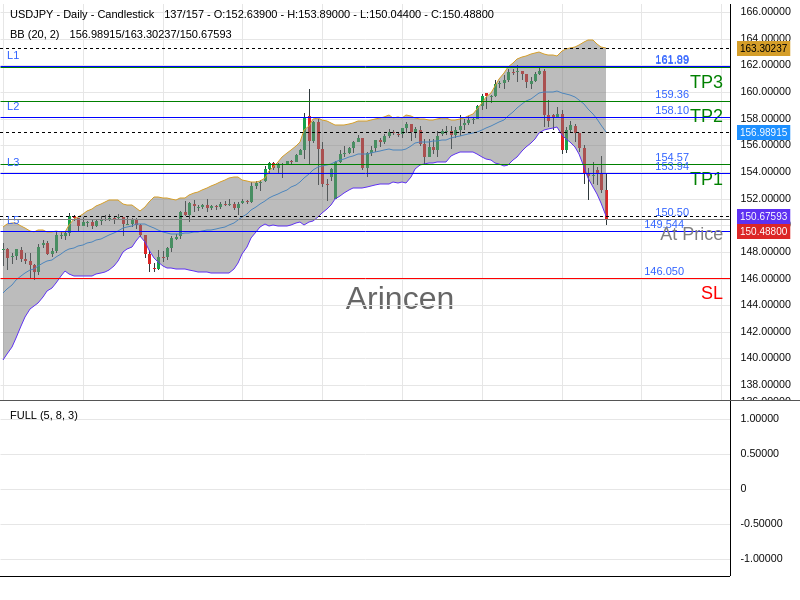

USDJPY

147.457

JPY

-1.711

(-1.15%)

Market Open

Yesterday

150.616

Open

150.613

Days's Range

150.491 - 151.106

Signals

khaled el qasem

2 months ago

khaled el qasem

2 months ago

sigmafx

2 months ago

sara abdelazim

2 months ago

khaled el qasem

2 months ago

MohamedAhmedFX

3 months ago

Related Instruments

News

Since the global financial crash of 2008, Japan’s yen has been mostly considered a dependable reserve currency. Once seen as the world’s third-largest safe haven currency due to its high liquidity and tight spreads, it is not considered safe anymore due to high volatility in the Japanese economy and markets. The USD/JPY has been favored by both experienced traders and beginners. One of the biggest pros of USD/JPY is its high daily liquidity, which creates volatility that generates many trading opportunities. Because the USD/JPY is strongly linked to the Japanese commodities market, the price swings created by the pair’s liquidity make these price movements predictable and profitable. The USD/JPY features low bid-ask spreads compared to other prominent currency pairs. These low spreads encourage trading and increase potential profits. However, there are drawbacks to consider, chiefly the volatility of this pairing, which can also lead to quick, significant losses for those not paying attention to the news cycle.